wichita ks sales tax on cars

What is the sales tax rate in Wichita Kansas. 10 New Hampshire 432 and 18 percent.

25 Vehicle Sales Agreement Free To Edit Download Print Cocodoc

Used Car Dealers Featured Taxes-Consultants Representatives.

. Find your perfect car with Edmunds expert reviews car comparisons and pricing tools. 915 sales tax X 0915 Kansas dealer sells a new car for 26000 and arranges. One of a suite of free online calculators provided by the team at iCalculator.

The rate ranges from 75 and 106. This will be collected in the tag office if the vehicle was purchased from an individual or out-of-state car dealer. The County sales tax rate is.

We issue license plates upon receipt of proper documentation and submission of the correct fees. All cars for sale motorcycles scooters for sale suvs for sale sedan for sale pickup trucks for sale. Right to the manufacturers rebate of 2500 to the dealer and instructs the dealer to use it to pay the first installment payments owed to the financing company.

This rate is the sum of the state county and city tax rates outlined below. The survey found Kansans pay about 495 a year in property tax on a 24000 car an effective tax rate of 206 percent. What are you looking for.

This is the total of state and county sales tax rates. Home is a 3 bed 20 bath property. Car Sales Tax on Private Sales in Kansas.

Kansas has recent rate changes Thu Jul 01 2021. Fast Easy Tax Solutions. Average Sales Tax With Local.

A 500 fee will be applied to each transaction handled at any of the Tag Offices. There may be additional sales tax based on the city of purchase or residence. Ad Find Out Sales Tax Rates For Free.

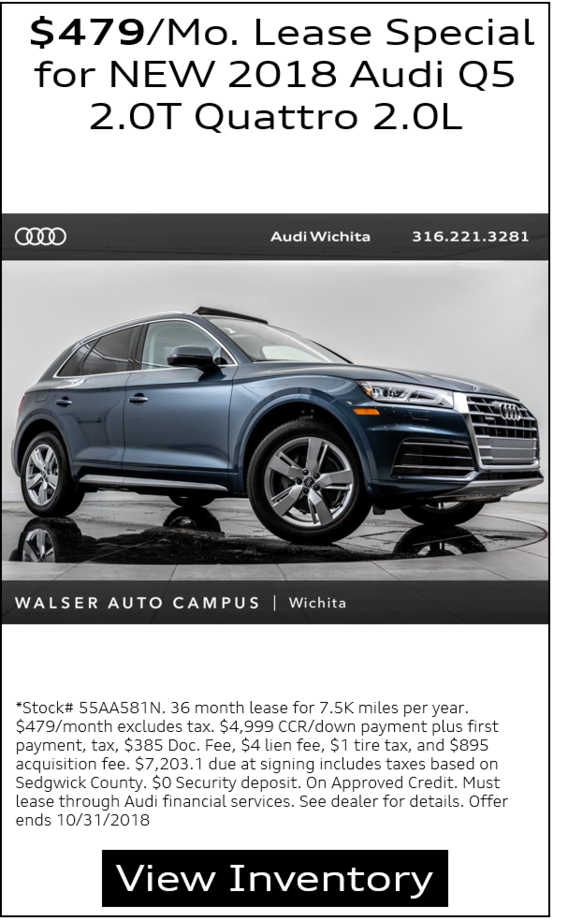

The Wichita sales tax rate is. The state sales tax rate in Kansas is 6500. The sales tax in Sedgwick County is.

You can find these fees further down on the page. The Kansas state sales tax rate is currently. See reviews photos directions phone numbers and more for Sales Tax locations in Wichita KS.

The seller must attach a copy of the vehicles current registration showing their name as owner and the lien holders name to the electronic sales agreement. Has impacted many state nexus laws and sales tax collection requirements. Get a great deal on one of 268 new Dodge Challengers in Wichita KS.

The minimum combined 2022 sales tax rate for Wichita County Kansas is. Wichita KS 67218 Email Sedgwick County Tag Office. The Kansas sales tax rate is currently.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. There are also local taxes up to 1 which will vary depending on region. Dealer should charge sales.

The 2018 United States Supreme Court decision in South Dakota v. Ad Optima Tax Relief 2 800 910-9619. See how we can help improve your.

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. See reviews photos directions phone numbers and more for Pay Sales Tax locations in Wichita KS.

Popular Counties All A B C D E F G H I J K L M N O P Q R S T U V W Y Z. For instance if you purchase a vehicle from a private party for 27000 and you live in a county that charges 8 total sales tax then you will have to multiply the 27000 sales amount by 08 and get 2160. The minimum combined 2022 sales tax rate for Wichita Kansas is.

Select the Kansas city from the list of popular cities below to see its current sales tax rate. In 2022 the minimum combined sales tax rate within Wichita Kansas 67202 zip codes is 75. That puts us between state No.

Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4. 1220 S Doreen St Wichita KS 67207-3118 is a single-family home listed for-sale at 114000. Vehicle Property Tax Estimator.

The Wichita County sales tax rate is. As part of the transaction the purchaser assigns its. The state sales tax applies for private car sales in Kansas.

What are you looking for. This form will allow the buyer to purchase a 60 day tag for 800 or 1000 at a substation. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984.

The rate in Sedgwick County is 75 percent. View more property details sales history and Zestimate data on Zillow. The buyer can also have the power of attorney odometer disclosure for electronic title filled.

Burghart is a graduate of the University of Kansas. The Wichita County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Wichita County Kansas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Wichita County Kansas. Kansas has a 65 statewide sales tax rate but also has 376 local.

If you have any questions regarding sales tax exemption please contact Loretta Knott at LKnottwichitagov or by phone at 316-268-4636. The current total local sales tax rate in Wichita KS is 7500. Used cars wichita ks at kansas auto sales our customers can count on quality used cars great prices and a knowledgeable sales staff.

This means that depending on your location within Kansas the total tax you pay can be significantly higher than the 65 state sales tax. Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1979 on top of the state tax. The fees include registration fees personal property taxes title fees and sales tax if applicable.

There are a total of 531 local tax jurisdictions across the state collecting an average local tax of 1979. The Wichita County Treasurers Office is an agent for the State of Kansas for registering and titling motor vehicles. The December 2020 total local sales tax rate was also 7500.

With local taxes the total sales tax rate is between 6500 and 10500. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. This is the total of state county and city sales tax rates.

See reviews photos directions phone numbers and more for Nys Auto Sales Tax Rate locations in Wichita KS. See reviews photos directions phone numbers and more for Kansas Sales Tax locations in Wichita KS. Kansas taxes cars three ways.

Used Dodge Journey For Sale Wichita Ks Derby Andover

Used Certified Loaner Vehicles For Sale In Wichita Hatchett Hyundai East

Used Cars Under 10 000 Near Andover Acura Of Wichita

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Wichita Volkswagen Dealer Mike Steven Volkswagen New Vw Cars Olathe New Volkswagen Mcpherson New Volkswagen Olathe

Wichita Auto Auction Home Facebook

Hatchett Hyundai West Is A Wichita Hyundai Dealer And A New Car And Used Car Wichita Ks Hyundai Dealership

Cars For Sale In Wichita Ks Kansas Auto Group

Sales Tax On Cars And Vehicles In Kansas

Kansas Vehicle Sales Tax Fees Find The Best Car Price

New 2021 2022 Kia For Sale In Wichita Midwest Kia Dealer

Midland Motors Llc The Home Of Cheap Cars In Wichita Ks Home Facebook

Car Sales Tax In Kansas Getjerry Com

2021 Volkswagen Id 4 For Sale In Wichita Wvggnpe21mp065127 Mike Steven Volkswagen